A Look Back at US Market Volatility on Election Night

By: CFE

The US election still has people buzzing with respect to the surprise outcome. Polls and other trends have been analyzed to determine just how so many experts got things so wrong with respect to the election. Many of those experts stated that if Donald Trump were to win the election the results would be disastrous for the US Equity markets with predictions of a quick 10% to 20% drop in major market indexes. These predictions have been proven untrue, but the night of the election the S&P 500 futures and VIX futures markets reacted as if the election results were going to be nothing short of catastrophic for the financial markets. This fear lasted about three hours and then subsided before the beginning of regular market hours in the United States.

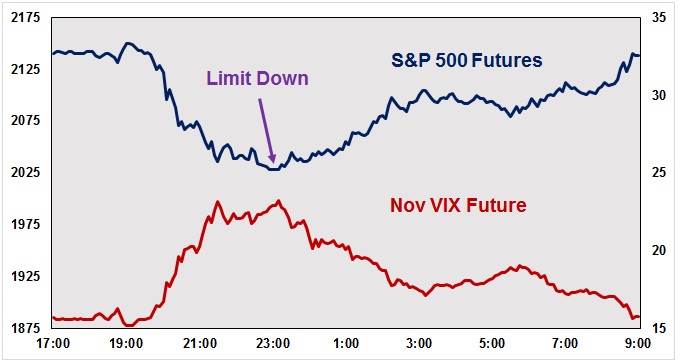

The following chart shows the price activity for the December S&P 500 Futures and November VIX Futures during the non-US hours session the night of the election. Volume is not depicted on the chart below, but it is worth noting that over 260,000 VIX futures contracts changed hands in the non-US session surpassing the previous record set the night of the surprise outcome of the Brexit referendum. Note for a brief period of time the S&P 500 Futures market price was limit down.

The first thing is not highlighted on the chart, but is very visible. Every piece of news that came out seemed to favor Donald Trump and for a few hours every new piece of information resulted in a new high in VIX futures and new lows in the S&P 500 futures.

Another thing worth highlighting is a bit subtler. As mentioned before, late in the evening S&P 500 futures were limit down. The flat price action below the purple arrow above shows this. VIX futures were still trading and did not make a new high when we hit the S&P limit. When the S&P futures commenced trading again note that VIX futures were dropping as the S&P futures were climbing. VIX is called ‘the fear’ index for a reason, and it did a pretty good job last night signaling when fear associated with the election results had peaked.

Finally as the evening wore on and Donald Trump made his victory speech the financial markets began to adjust back to normal as he came across more presidential than he had during the campaign. By the time the overnight session was completed both the S&P 500 and VIX futures were very close to where they were trading before US election results started coming in the night before. With 24 hour trading available November VIX futures went through the process of digesting the uncertainty or fear of a Trump administration to returning to a more normal level. All this happened while the US markets were not fully open for trading.

RISK DISCLAIMER: Trading in futures products entails significant risks of loss which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies cited herein is not necessarily indicative of future performance. The information contained herein is provided to you for information only and believed to be drawn from reliable sources but cannot be guaranteed; Phillip Capital Inc. assumes no responsibility for errors or omissions. The views and opinions expressed in this letter are those of the author and do not reflect the views of Phillip Capital Inc. or its staff.