ASX Update

By: ASX

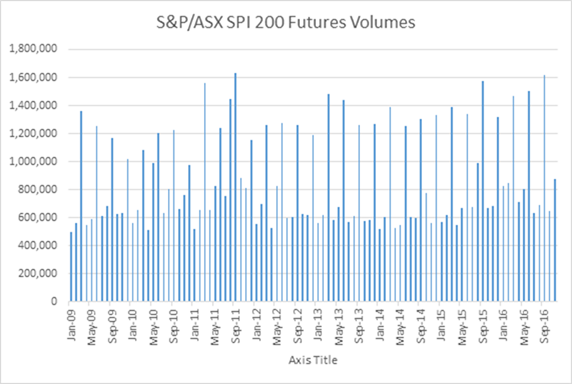

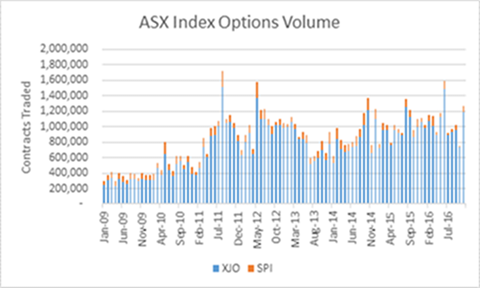

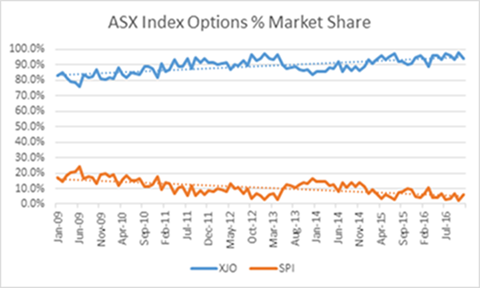

The Australian index derivatives market continues to attract record open interest levels. Headlined by the S&P/ASX 200 (SPI) Futures contract and supported by the recent introduction of weekly options over the same index. Recent events including Brexit and the US election have seen increased volumes in Australian index derivatives due to it being the first market open each trading day – offering opportunities while other equity markets are closed.

Trading volumes are up over 10% in the past 3 years with over $6.1billion AUD in average notional value for futures traded each day, again up over 10% in the last 3years. Options are up over 28% for the past 3 years to $2.8billion in notional value per day

RISK DISCLAIMER: Trading in futures products entails significant risks of loss which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies cited herein is not necessarily indicative of future performance. The information contained herein is provided to you for information only and believed to be drawn from reliable sources but cannot be guaranteed; Phillip Capital Inc. assumes no responsibility for errors or omissions. The views and opinions expressed in this letter are those of the author and do not reflect the views of Phillip Capital Inc. or its staff.